China approves Yanzhou bid for Felix Resources

China regulators approve Yanzhou Coal's bid for Australian coal miner Felix Resources

BEIJING (AP) -- Chinese regulators have approved a bid by state-owned Yanzhou Coal to take over Australian miner Felix Resources Ltd., the company said in a statement.

The statement, posted Friday on the Hong Kong Stock Exchange, said China's National Development and Reform Commission issued an approval letter Thursday.

The offer values Felix at 3.5 billion Australian dollars ($3.2 billion), making the deal China's biggest investment yet in the Australian minerals sector.

Felix shareholders approved the deal in August and the Australian government gave it the green light in October.

The A$16.95-a-share offer is the latest bid by a Chinese state-owned company to buy a chunk of Australia's raw materials to guarantee its steel-making and other construction industries can meet the demands of China's booming economy.

The progress of similar acquisition attempts by other Chinese state-owned companies has been rocky.

Debt-laden Rio Tinto in June abandoned a $19.5 billion bid from China's Chinalco to increase its stake in the Anglo-Australian miner to 18 percent, a deal that met investor resistance and opposition from some politicians who said it was against Australia's national interest.

China Minmetals Nonferrous Metals Co. Ltd. had to amend its bid for Oz Minerals after the Australian government said the Chinese company could not buy a mine located inside an Australian military area. The company eventually bought all of Oz Minerals apart from that mine for A$1.7 billion.

Sunday, December 06, 2009 | 2 Comments

Is the Economy Really Getting Better?

Are Things Really Getting Better?

Friday, December 4, 2009provided by

Last quarter, the economy grew by the largest amount since the summer of 2007, but there are signs that things are still getting worse.

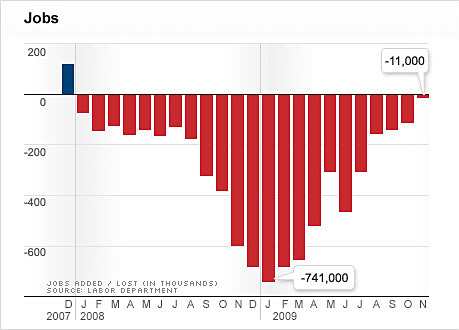

Jobs: Losses Slowing

|

What it is: Each month, the government calculates how many people are on private and government payrolls across every sector to determine how many jobs the economy is creating or losing.

Why it's important: The economy is still shedding jobs by the hundreds of thousands each month. Even though the number has decreased substantially from the recession's peak, economists say a true recovery cannot take place until a good number of jobs are created each month.

Where we're headed: The labor market has historically dragged its feet at the beginning of an economic rebound, as businesses wait for sure signs of a recovery before hiring. And the trend needs to continue in the right direction before we can reasonably talk about job creation.

Best: Sept. 1983, +1,114. Coming out of the deepest recessions of all time, the economy and job creation roared back in 1983.

Worst: Sept. 1945, -1,966. As the war wound down in late 1945, war machinery makers laid off unneeded workers by the thousands.

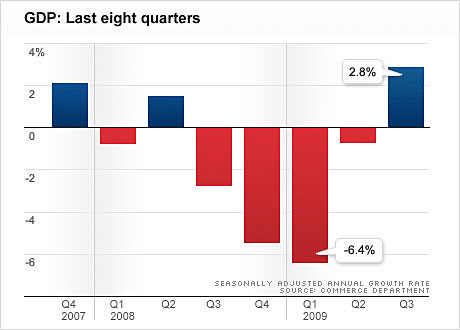

GDP: Strong Return to Growth

|

What it is: Gross domestic product is the broadest measure of the nation's economy. GDP measures what individuals, businesses and the government spend as well as the net impact of the nation's imports and exports.

Why it's important: Economists use GDP as one of several data points to determine whether the economy is in a period of recession or expansion. The 2008-2009 recession was one of the deepest ever -- it was the first time in history in which the economy retreated for four straight quarters.

Where we're headed: The economy returned to positive growth in the last three months after contracting by 3.7% since the recession began. But experts warn that government stimulus programs like Cash for Clunkers contributed strongly to the economic expansion and that the economic recovery is more fragile than the GDP numbers may suggest.

Best: 1950, 1st quarter, +17.2%. GDP soared in the early 1950s as the post-war business cycle reached its peak with unemployment at 4%.

Worst: 1958, 1st quarter, -10.4%. GDP hit its worst point during the Great Depression, with a decline of 29%. Since WWII it hasn't gone below 10%.

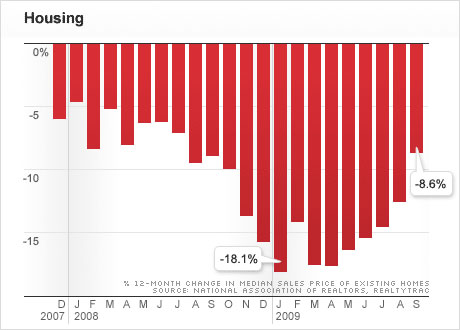

Housing: Slow Improvement

|

What it is: Home values affect all property owners, so the change in prices of homes sold by homeowners is one of the more informative readings on the health of the housing market.

Why it's important: Home prices serve as a key measure of consumers' wealth and the financial sector's overall stability. When home prices rise, consumers have more funds to borrow and spend. Rising prices also means the value of financial institutions' large real estate portfolios increase, which, in theory, gives banks more of a cushion to lend.

Where we're headed: Home prices have begun to stabilize, as sales have risen on the back of the Recovery Act's homebuyer tax credit. Home foreclosures, which have totaled 6.3 million during the recession, have fallen slightly in the past two months but have trended sharply higher over the past two years.

Best: Oct. 2005, +16.6%. The housing bubble of the mid-2000s hit its peak in late 2005.

Worst: Jan. 2009, -18.1%. When the bubble burst, prices fell by a record amount.

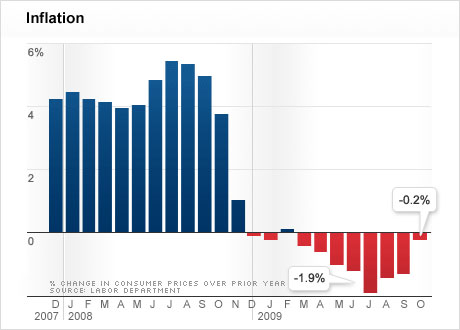

Inflation: Okay for Now

|

What it is: Inflation measures the rise of prices and the value of money. When inflation is high, money is worth less over time. Deflation, the opposite of inflation, occurs when prices fall over time.

Why it's important: Moderate inflation (between 1% and 2% annual rise in prices) is good for the economy, as it typically contributes to job and wage growth. Out-of-control inflation is dangerous, as money loses its value. Deflation is equally dangerous, because it typically leads to job loss and declining salaries.

Where we're headed: The Federal Reserve has said there is no immediate risk of high inflation, and they are watching prices carefully for hints of a deflationary period. But economists say the massive amounts of government spending from the bailouts and stimulus package mean inflation could spiral out of control next year if the economy recovers without reining in the spending.

Best: March 1980, +14.6%. Inflation soared despite a recession - giving rise to the term "stagflation." The FED hiked interest rates to combat it.

Worst: Aug. 1949, -3%. A deep recession dragged prices way down in the summer of 1949.

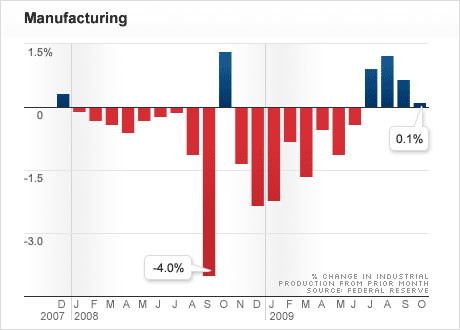

Manufacturing: Tepid Growth

|

What it is: Industrial production is a broad measure of the nation's manufacturing sector. The index measures the output of factories that make consumer goods, business equipment and raw materials. It also measures output from the construction, mining and utilities industries.

Why it's important: When there is a strong demand for goods, the manufacturing sector increases jobs, makes more products and adds to business' inventories. All of those items factor directly into GDP and the health of the overall economy.

Where we're headed: The manufacturing sector has grown for the last three months after contracting in 17 of the previous 18 months. Business' inventories are currently at bare bones, suggesting the manufacturing bounceback will continue. But factories are currently operating at only 70% capacity, about 11 percentage points below average. Economists say that manufacturers will have to utilize their own dormant capacity before they start hiring new factory workers.

Best: May 1933, +16.6%. The country came out of the Great Depression in an enormous recovery, but fell into another depression shortly after.

Worst: Aug. 1945, -10.4%. As World War II wound down in the late 1945, manufacturers stopped producing weapons and vehicles for the armed forces.

Sunday, December 06, 2009 | 0 Comments

Analysis: Obama's consumer agency no sure deal

Analysis: Consumer agency, weaker than Obama sought, faces even tougher slog ahead

WASHINGTON (AP) -- Take a hard look now. A new agency that consumers were promised would make bankers, credit card companies and mortgage lenders treat them fairly will never look as strong again.

AP - President Barack Obama takes his leave after speaking at a fundraiser for Sen. Chris Dodd, D-Conn., left, in ...

Legislation to establish President Barack Obama's proposed Consumer Financial Protection Agency cleared a key hurdle this week. But it's already been watered down from what Obama proposed and will likely become even weaker when it comes up against higher hurdles on the House floor and in the Senate. It may even die along the way.

Banks flatly oppose a new consumer agency, arguing their current regulators can handle the task. The U.S. Chamber of Commerce has weighed in with a $2 million ad campaign against the plan. And some industry claims, particularly those from bankers back home, have proved persuasive with many lawmakers.

Ahead lie enormous obstacles: potentially debilitating amendments on the House floor and, ultimately, a tougher Senate landscape, where Republican support is essential to passage of any new financial regulation scheme.

"If they are insisting on a separate agency, a stand alone agency, it's going to be difficult to do a bipartisan bill," Sen. Richard Shelby of Alabama, top Republican on the Senate banking committee, said in an interview. "I wouldn't be interested in a stand alone consumer agency."

The committee's Democratic chairman, Sen. Christopher Dodd of Connecticut, has championed the agency and voiced frustration over the industry criticism.

There are "all sorts of ways" to address consumer protection, Dodd said in a brief interview, and emphasized the need to re-regulate large financial institutions so they can't again trigger catastrophic failures that ripple throughout the economy.

"Of all the things we're doing, this fixation and this preoccupation with that one issue is a little misplaced," he said of attacks on the consumer agency.

Hints of looming pitfalls for a new consumer agency were evident in the debate this week before the House Financial Services Committee. Even there, where the president's party holds a 42-29 edge, Obama didn't get all he wanted. Up until the end, White House aides buttonholed individual members, fighting unsuccessfully against yet another exemption to the powers of the proposed consumer protection agency.

The panel's chairman, Massachusetts Rep. Barney Frank, acknowledged later that of all the aspects of financial regulation that he is contending with, the consumer agency was politically the most difficult. Indeed, consumer advocates applauded him for preserving as many consumer protections as he did.

Still, Travis Plunkett of the Consumer Federation of America called the bill "battered and bruised."

Obama had called for a robust agency to police the fine print of credit cards, mortgages and other services ranging from payday loans to auto financing. The president wanted to make banks offer standardized "plain vanilla" mortgages, simple no frills home loans that customers could compare to more elaborate mortgages. He wanted to make lenders communicate with their customers more clearly. And he wanted to invest the new agency with the power to examine bank books, along with the other regulators already checking banks for their safety and soundness.

As the legislation stands now, all those measures are gone or compromised.

The idea of standardized mortgages, which administration officials had held up as a key protection for consumers, proved hard to sell even to Democrats. In the end, it wasn't a matter of bowing to the big banking lobbies but rather lawmakers listening to business leaders back home -- the bankers, auto dealers and Rotarians who make up the fabric of local politics

Moderate committee Democrats succeeded in exempting thousands of banks from examination by the consumer agency, though they'd still have to abide by its rules. They argued that small community banks would be overburdened with regulators and hadn't been the cause of the financial crisis anyway. But the standard measure of a community bank is one that holds assets of $1 billion or less. There are about 7,500 such banks across the country.

The committee, however, decided to make any bank with assets under $10 billion off limits to the new consumer agency's examiners. There were also exemptions for retailers, title insurance providers, and, finally, auto dealers, although the scope of the latter is somewhat uncertain.

It was the auto dealers exception that the White House fought to no avail Thursday. While the agency would still regulate firms that provide auto financing themselves, consumer advocates say dealers are the ones who make the financing pitch no matter who actually makes the loan and should be equally covered.

The Obama administration also wanted states to have the right to write consumer laws that are tougher than federal regulations. Facing opposition from some moderate Democrats, the committee adopted a compromise that gives federal regulators the right to pre-empt state laws on a case-by-case basis.

In many instances, the changes had grudging support from most Democrats but passed by voice vote with the backing of committee Republicans. Ultimately, though, only one Republican voted for the final legislation.

"In the end," said committee Democrat Emanuel Cleaver of Missouri, "we have weakened legislation that the opposition is not going to support."

Saturday, October 24, 2009 | 3 Comments

US unveils broad effort to limit executive pay

US unveils broad effort to limit executive pay and risk-taking that led to financial crisis

The Treasury Department ordered seven big companies that haven't repaid their government bailout money to cut their top executives' average total compensation -- salary and bonuses -- in half, starting in November. Under the plan, cash salaries for the top 25 highest-paid executives will be limited to $500,000 and, in most cases, perks will be capped at $25,000.

The Federal Reserve came at the issue from another direction. It proposed to monitor pay packages at thousands of banks -- even those that never received bailout money -- to ensure they don't encourage reckless gambles.

Neither plan, though, is expected to kill Wall Street's culture of lavish pay. The Fed proposal doesn't set specific limits on executive compensation, so it's unclear how it would actually affect pay. And the Treasury plan covers only 175 people, with the pay limits lasting only until the companies repay what they received from the $700 billion bailout fund.

For the already struggling companies, it also introduces a new concern: brain drain. The executives targeted by "pay czar" Kenneth Feinberg are among the most talented and productive at their companies.

"These people are considered the brains of the machine," said Steven Hall, who runs an executive compensation firm bearing his name. "They are who can pull you through the tough times. This will give them reason to leave."

The Treasury plan is limited to the seven bailed-out companies -- Bank of America Corp., American International Group Inc., Citigroup Inc., General Motors, GMAC, Chrysler and Chrysler Financial. The Fed's proposal is much broader in scope, covering nearly 6,000 banks and a wider range of employees -- from executives to traders to loan officers.

Rather than set pay levels at specific banks, the Fed would review -- and could veto -- pay policies. The plan is subject to a 30-day public comment period.

David Yermack, a finance professor at the Stern School of Business at New York University, called Treasury's pay curbs a "symbolic" act.

"I think the government is trying to make examples of some banks and hoping others will follow," Yermack said. "I think that's naive. Wall Street bankers and traders are motivated by money, and they're going to work for whoever pays them the most."

He predicted the seven firms would find ways to bypass the curbs through implicit promises that aren't written in contracts.

"They could say to someone, 'I'll give you a really big bonus three or four years from now. Just be patient,'" Yermack said. "There's an understanding that if you play the game, you'll be taken care of. That's been going on as long as there have been businesses, and Feinberg isn't going to be able to stop that."

Feinberg restructured the pay packages for top executives to provide a base salary and a portion described as "stock salary." The employees must hold the stock for two years. They can then sell only one-third of the stock payment each year for three years.

Feinberg said his goal was to tie compensation more closely to the long-term performance of the company.

In one pay plan, the three highest earners at Citigroup will receive a base salary of $475,000. Each executive also will be paid between $5.6 million and $5.8 million in company stock to be redeemed beginning in 2011. The third category of long-term restricted stock will equal $3 million for each executive.

The Feinberg plan provides an escape clause that might let some executives avoid the restrictions: It says the rules allow for "exceptions where necessary to retain talent and protect taxpayer interests."

According to Feinberg, base salaries above $1 million were approved for the new CEO of AIG, and for two employees of Chrysler Financial.

Under a package approved by Feinberg over the summer, AIG CEO Robert Benmosche will get a pay package of about $10.5 million.

Feinberg became pay czar earlier this year as Congress was responding to outrage about huge bonuses being paid to AIG. Lawmakers amended the bailout law to require that executive compensation at companies getting exceptional assistance be curbed. Feinberg has been reviewing compensation packages since August.

President Barack Obama welcomed Treasury's decision and urged Congress to pass legislation to give shareholders a voice in executive pay packages.

"It does offend our values when executives of big financial firms that are struggling pay themselves huge bonuses even as they rely on extraordinary assistance to stay afloat," Obama said.

In an interview with CNBC, Feinberg was asked if he thought the restrictions would influence pay at other Wall Street firms outside his authority.

"I hope so, but that would be voluntary," he said. "It's not the government's business."

Some observers said the changes could have a broader influence on pay beyond the seven companies.

"It's going to put them in a position of having to be more aggressive in defending their arrangements now that you've got an alternative out there that's been blessed by the government," said Mark Borges, a principal with Compensia, a Northern California compensation consulting firm.

It's also possible the restrictions could help govern pay at the thousands of banks that would be affected by the Fed's plan, said Charles Elson, director of the University of Delaware's Weinberg Center for Corporate Governance.

"It's highly probable that the Fed could use this as a model in their own guidelines, and yes, I think that would have a significant impact on pay," he said.

Some analysts saw the potential for restrictions to backfire. Yermack said linking pay to long-term incentives like deferred stock can encourage more excessive risk-taking, not less.

"If you want people to take more risks, pay them more in stock," he said. "It holds out the possibility of very big gains in a way that fixed contracts do not."

Others said the restrictions reinforced what many financial observers see as a banking system divided between the haves and have-nots. They wondered whether pay caps could jeopardize taxpayer money by making it harder for bailed-out firms to retain and hire top talent.

"You have got the companies that are unencumbered and can offer anyone anything they want, and you've got the other companies that are stuck with what they have," said David Schmidt, a senior consultant on executive pay at James F. Reda & Associates. "It creates a bit of a dilemma in banks' efforts to repay taxpayers."

A Bank of America spokesman complained that the restrictions would hurt its competitiveness.

"Competitors not subject to the pay restrictions already are exploiting this situation by identifying our top performers and using pay concerns to recruit them away for fair market compensation," spokesman Scott Silvestri said.

GM said it will adopt the compensation changes outlined by Feinberg by shifting its pay packages toward non-cash compensation tied to company performance.

CEO Fritz Henderson's base salary was cut 30 percent to about $1.3 million earlier this year when GM accepted government loans. Henderson received compensation valued at about $8.7 million in 2008, but much of that included stock and options that now are nearly worthless due to GM's bankruptcy filing.

Chrysler Group LLC CEO Sergio Marchionne and other Fiat executives who work for both Chrysler and Fiat were exempted from the pay cuts as part of the agreement with the U.S. government to take over management control of Chrysler.

Executives who work solely for Chrysler could be affected, but many of the top earners under Chrysler's former owner have left the company.

Under the Fed proposal, the 28 biggest banks would develop their own plans to make sure compensation doesn't spur undue risk-taking. If the Fed approves, the plan would be adopted and bank supervisors would monitor compliance.

At smaller banks -- where compensation is typically less -- Fed supervisors will conduct reviews. Those banks don't have to submit plans.

The Fed refused to identify the 28 banks that will have to submit plans. But Citigroup, Bank of America and Wells Fargo & Co. are usually included on such lists. Nearly 6,000 banks regulated by the Fed would be covered.

Jacobs reported from New York. Associated Press Writers Daniel Wagner, Jeannine Aversa, Ken Thomas, Jim Kuhnhenn and Marcy Gordon in Washington, Ieva M. Augstums in Charlotte, N.C., and Tom Krisher in Detroit contributed to this report.

Thursday, October 22, 2009 | 0 Comments

Poll: US belief in global warming is cooling

Belief in global warming is cooling, poll says, as Congress weighs limits on emissions

WASHINGTON (AP) -- Americans seem to be cooling toward global warming.

AP - Nobel Prize laureate 2007 and Chairman of the intergovernmental panel on Climate Change Rajendra K. Pachauri speaks during ...

Just 57 percent think there is solid evidence the world is getting warmer, down 20 points in just three years, a new poll says. And the share of people who believe pollution caused by humans is causing temperatures to rise has also taken a dip, even as the U.S. and world forums gear up for possible action against climate change.

In a poll of 1,500 adults by the Pew Research Center for the People & the Press, released Thursday, the number of people saying there is strong scientific evidence that the Earth has gotten warmer over the past few decades is down from 71 percent in April of last year and from 77 percent when Pew started asking the question in 2006. The number of people who see the situation as a serious problem also has declined.

The steepest drop has occurred during the past year, as Congress and the Obama administration have taken steps to control heat-trapping emissions for the first time and international negotiations for a new treaty to slow global warming have been under way. At the same time, there has been mounting scientific evidence of climate change -- from melting ice caps to the world's oceans hitting the highest monthly recorded temperatures this summer.

The poll was released a day after 18 scientific organizations wrote Congress to reaffirm the consensus behind global warming. A federal government report Thursday found that global warming is upsetting the Arctic's thermostat.

Only about a third, or 36 percent of the respondents, feel that human activities -- such as pollution from power plants, factories and automobiles -- are behind a temperature increase. That's down from 47 percent from 2006 through last year's poll.

"The priority that people give to pollution and environmental concerns and a whole host of other issues is down because of the economy and because of the focus on other things," suggested Andrew Kohut, the director of the research center, which conducted the poll from Sept. 30 to Oct. 4. "When the focus is on other things, people forget and see these issues as less grave."

Andrew Weaver, a professor of climate analysis at the University of Victoria in British Columbia, said politics could be drowning out scientific awareness.

"It's a combination of poor communication by scientists, a lousy summer in the Eastern United States, people mixing up weather and climate and a full-court press by public relations firms and lobby groups trying to instill a sense of uncertainty and confusion in the public," he said.

Political breakdowns in the survey underscore how tough it could be to enact a law limiting pollution emissions blamed for warming. While three-quarters of Democrats believe the evidence of a warming planet is solid, and nearly half believe the problem is serious, far fewer conservative and moderate Democrats see the problem as grave. Fifty-seven percent of Republicans say there is no solid evidence of global warming, up from 31 percent in early 2007.

Though there are exceptions, the vast majority of scientists agree that global warming is occurring and that the primary cause is a buildup of greenhouse gases in the atmosphere from the burning of fossil fuels, such as oil and coal.

Jane Lubchenco, head the National Oceanic and Atmospheric Administration, told a business group meeting at the White House Thursday: "The science is pretty clear that the climate challenge before us is very real. We're already seeing impacts of climate change in our own backyards."

Despite misgivings about the science, half the respondents still say they support limits on greenhouse gases, even if they could lead to higher energy prices. And a majority -- 56 percent -- feel the United States should join other countries in setting standards to address global climate change.

But many of the supporters of reducing pollution have heard little to nothing about cap-and-trade, the main mechanism for reducing greenhouse gases favored by the White House and central to legislation passed by the House and a bill the Senate will take up next week.

Under cap-and-trade, a price is put on each ton of pollution, and businesses can buy and sell permits to meet emissions limits.

"Perhaps the most interesting finding in this poll ... is that the more Americans learn about cap-and-trade, the more they oppose cap-and-trade," said Sen. James Inhofe, R-Okla., who opposes the Senate bill and has questioned global warming science.

Regional as well as political differences were detected in the polling.

People living in the Midwest and mountainous areas of the West are far less likely to view global warming as a serious problem and to support limits on greenhouse gases than those in the Northeast and on the West Coast. Both the House and Senate bills have been drafted by Democratic lawmakers from Massachusetts and California.

One of those lawmakers, Sen. Barbara Boxer of California, told reporters Thursday that she was happy with the results, given the interests and industry groups fighting the bill.

"Today, to get 57 percent saying that the climate is warming is good, because today everybody is grumpy about everything," Boxer said. "Science will win the day in America. Science always wins the day."

Earlier polls, from different organizations, have not detected a growing skepticism about the science behind global warming.

Since 1997, the percentage of Americans that believe the Earth is heating up has remained constant -- at around 80 percent -- in polling done by Jon Krosnick of Stanford University. Krosnick, who has been conducting surveys on attitudes about global warming since 1993, was surprised by the Pew results.

He described the decline in the Pew results as "implausible," saying there is nothing that could have caused it.

The poll's margin of error was plus or minus 3 percentage points.

Associated Press writers Seth Borenstein and Kevin Freking contributed to this report.

Thursday, October 22, 2009 | 1 Comments

IMF pledges voting power to developing countries

IMF says it is committed to giving more voting power to developing countries

ISTANBUL (AP) -- A key panel of the International Monetary Fund said Sunday that it supports giving more voting power to emerging market and developing countries, warning that the legitimacy of the institution was at stake.

AP - Dominique Strauss-Kahn, Managing Director of the International Monetary Fund, IMF, speaks during a news conference in Istanbul, Turkey, ...

The group's International Monetary and Financial Committee said it backs a shift of at least 5 percent of voting power from countries with ample representation to those with little influence. The move would seek to reflect changes in the global economy, with strong growth in countries that once lagged far behind the elite club of rich nations.

"Quota reform is crucial for increasing the legitimacy and effectiveness of the Fund," the committee said in a statement. It planned to review progress at its next meeting in Washington on April 24, and sought an agreement on the voting shift by January 2011. The change would then be subject to approval by the legislatures of some member countries.

"This is a process that will take time. It won't happen overnight," said committee chairman Youssef Boutros-Ghali. "We are reforming an organization that is complex, sophisticated and reaching every corner of the world economy."

The committee, which sets the IMF's agenda, said it was also committed to protecting the voting share of its poorest members. Panel members include IMF Managing Director Dominique Strauss-Kahn and U.S. Treasury Secretary Timothy Geithner, and other finance chiefs.

The announcement came at the IMF's annual meeting, held this year in Istanbul. It followed a decision at a Pittsburgh forum that the G-20 nations would become the world's main economic decision-making forum, effectively taking over the role of the G-7 group of rich countries.

Earlier Sunday, Geithner said "a more representative, responsive and accountable governance structure is essential to strengthening the IMF's legitimacy."

He noted that G-20 countries had committed to shift some control in the IMF to countries with relatively little input. The Group of 20 includes developing economic powerhouses such as China, India and Brazil.

Geithner said the IMF should outline soon how the proposed transfer of voting power can occur. He said reform of the IMF's executive board was vital to modernizing the Washington-based institution, which represents 186 countries. The U.S. recommends reducing the board size while preserving the current number of emerging market and developing country chairs.

The IMF is usually headed by a European and the World Bank by an American. It has received pledges of more money to help poor countries struggling to emerge from the global economic crisis, and a broader range of nations wants to have more say in how the funds are handled.

Aid agency OXFAM says current voting formulas at the IMF give Luxembourg more weight than the Philippines, which has almost 200 times the population. It said the 5 percent shift in voting power was insufficient.

"They need to give more voice to the poorest countries, have fewer European seats on the Board, and get rid of the U.S. veto," said Caroline Pearce, OXFAM policy adviser. She said the IMF can only be relevant if it gives "countries hardest hit by the financial crisis a say in their own destiny."

The U.S. has a 17 percent voting stake in the IMF, effectively giving it veto power because major decisions require an 85-percent majority to pass.

SOLIDAR, a European network of non-governmental organizations, said the calls for a 5 percent shift amounted to "grandstanding" that distracted attention from the harsh impact of IMF austerity policies in nations including Ethiopia and Latvia.

"Governments are still being forced to cut pensions, jobs in the public sector, unemployment benefits, teacher's salaries, and the list goes on," Andrea Maksimovic of SOLIDAR said in a statement.

The IMF has often been criticized for allegedly imposing tough measures on countries in exchange for loans and without sufficient regard for the impact on the poor.

IMF officials say they have shown more flexibility in recent years. John Lipsky, the IMF's No 2. official, has said the IMF is undertaking "substantial efforts" toward internal reform that will provide "a fair shake for all our members."

At the Istanbul conference, a group of 35 heavily indebted countries welcomed the G-20's new role as a leader in global economic decisions, but said poor nations also needed representation to express their financing needs.

"We need at least one seat so that almost 1 billion Africans can express their views," said Lazare Essimi Menye, Cameroon's finance minister.

Associated Press Writer Suzan Fraser contributed to this report.

Sunday, October 04, 2009 | 0 Comments

Paging Dr. Tesla? Automaker to make house calls

Electric carmaker Tesla Motors to begin offering house calls for service and repairs

NEW YORK (AP) -- Electric carmaker Tesla Motors is launching a maintenance plan where mechanics travel to owners' homes or offices to perform repairs and tuneups.

Tesla, which makes the $109,000 Roadster electric car, said the plan is convenient for customers who won't have to bring their vehicle to a showroom, while cutting costs by making a large network of Tesla service locations unnecessary.

"You know how there's a Chevy dealer on every block or strip mall? We don't intend to have a footprint like this," spokeswoman Rachel Konrad said.

But the service won't be cheap. The carmaker will charge vehicle owners $1 for every roundtrip mile its technicians travel, from showroom to garage, with a minimum charge of $100 per trip.

For the Tesla driver in Manhattan, where the company opened a store over the summer, the cost won't be much. But for Roadster devotees in Honolulu, that's a charge of about $4,800 per trip -- not including the cost of repair.

Still, Konrad said the maintenance cost will still be low because electric cars have fewer moving parts and require less "care and feeding" than vehicles powered by internal combustion.

The company said a recall of hundreds of Roadsters in May to address a steering problem was in part the inspiration for the plan. Rather than ask owners to bring the vehicle to a showroom -- there are only four currently in the U.S. -- it sent technicians to repair the cars at their homes and offices. The response was overwhelmingly positive, Konrad said.

The San Carlos, California-based startup has so far sold about 700 Roadsters, its only vehicle on the market now. The company in June was approved for $465 million in loans from the U.S. Department of Energy to help it build next-generation electric cars.

It has plans to introduce an electric sedan, the Model S, which it hopes to price under $50,000 after government rebates when it goes on sale in 2011.

The new service plan will be standard for all new Tesla vehicles and current owners will have their warranties updated so they are covered by the new plan, Konrad said.

Sunday, October 04, 2009 | 0 Comments

ap Cybersecurity starts at home and in the office

As US faces growing cyberthreats, everyday users must learn to block the digital doorways

WASHINGTON (AP) -- When swine flu broke out, the government revved up a massive information campaign centered on three words: Wash your hands. The Obama administration now wants to convey similarly clear and concise guidance about one of the biggest national security threats in your home and office -- the computer.

AP - In this Sept. 18, 2007 file photo, National Intelligence Director Mike McConnell testifies on Capitol Hill in Washington. ...

Think before you click. Know who's on the other side of that instant message. What you say or do in cyberspace stays in cyberspace -- for many to see, steal and use against you or your government.

The Internet, said former national intelligence director Michael McConnell, "is the soft underbelly" of the U.S. today. Speaking at a new cybersecurity exhibit at the International Spy Museum in Washington, McConnell said the Internet has "introduced a level of vulnerability that is unprecedented."

The Pentagon's computer systems are probed 360 million times a day, and one prominent power company has acknowledged that its networks see up to 70,000 scans a day, according to cybersecurity expert James Lewis.

For the most part, those probes of government and critical infrastructure networks are benign. Many, said McConnell, are a nuisance and some are crimes. But the most dangerous are probes aimed at espionage or tampering with or destroying data.

The attackers could be terrorists aiming at the U.S. culture and economy, or nation-states looking to insert malicious computer code into the electrical grid that could be activated weeks or years from now.

"We are the fat kid in the race," said Lewis. "We are the biggest target, we have the most to steal, and everybody wants to get us."

And if, for example, the U.S. gets into a conflict with China over Taiwan, "expect the lights to go out," he said.

The exhibit at the Spy Museum -- "Weapons of Mass Disruption" -- tries to bring that threat to life.

A network of neon lights zigzags across the ceiling. Along the walls computer screens light up with harrowing headlines outlining the country's digital dependence. Drinking water, sewer systems, phone lines, banks, air traffic, government systems, all depend on the electric grid, and losing them for weeks would plunge the country into the 1800s.

Suddenly, the lights go out and the room is plunged into silent darkness.

Seconds later as the sound system crackles, a video ticks off a pretend crisis: no food, no water, system shutdown.

That faux threat has become a prime concern for the government, but fully protecting the grid and other critical computer systems are problems still waiting a solution.

Federal agencies, including the Pentagon and the Department of Homeland Security, are pouring more money into hiring computer experts and protecting their networks.

But there are persistent questions about how to ensure that Internet traffic is safe without violating personal privacy.

One answer, experts said last week, is to begin a broader public dialogue about cybersecurity, making people more aware of the risks and how individuals can do their part at home and at work.

Some will find it easier than others.

Much of the younger generation has grown up online and are more likely to know about secure passwords, antivirus software and dangerous spam e-mails that look to steal identities, bank accounts and government secrets.

Older people moved into the digital universe as it began to evolve and most have not grown up thinking about how to protect themselves online.

"Detection and prevention are fast, but crime is still faster," said Phil Reitinger, director of the National Cybersecurity Center. The key, he said, "is to make sure that we're all getting the word out about not only the seriousness of the threat, but the fairly simple steps that people can take to help secure their systems and their lives and families from the threats that are out there."

In the computer world, "wash your hands" is less about tossing your keyboard into the dishwasher -- although some have tried -- and more about exercising caution.

Those steps include:

--using antivirus software, spam filters, parental controls and firewalls.

--regularly backing up important files to external computer drives.

--thinking twice before sending information over the Internet, particularly when using wireless or unsecured public networks.

Sunday, October 04, 2009 | 0 Comments

BP taps vast pool of crude in deepest oil well

BP drills deepest-ever oil well in Gulf of Mexico, taps vast pool of crud

NEW YORK (AP) -- Nearly seven miles below the Gulf of Mexico, oil company BP has tapped into a vast pool of crude after digging the deepest oil well in the world. The Tiber Prospect is expected to rank among the largest petroleum discoveries in the United States, potentially producing half as much crude in a day as Alaska's famous North Slope oil field.

Related Quotes

| Symbol | Price | Change |

|---|---|---|

| COP | 44.34 | +0.19 |

| | ||

| CVX | 68.04 | -0.44 |

| | ||

The company's chief of exploration on Wednesday estimated that the Tiber deposit holds between 4 billion and 6 billion barrels of oil equivalent, which includes natural gas. That would be enough to satisfy U.S. demand for crude for nearly one year. But BP does not yet know how much it can extract.

"The Gulf of Mexico is proving to be a growing oil province, and a profitable one if you can find the reserves," said Tyler Priest, professor and director of Global Studies at the Bauer College of Business at the University of Houston.

The Tiber well is about 250 miles southeast of Houston in U.S. waters. At 35,055 feet, it is as deep as Mount Everest is tall, not including more than 4,000 feet of water above it.

Drilling at those depths shows how far major oil producers will go to find new supplies as global reserves dwindle, and how technology has advanced, allowing them to reach once-unimaginable depths.

Deep-water operations are considered to be the last frontier for pristine oil deposits, and the entire petroleum industry is sweeping the ocean floor in search of more crude.

BP needs to invest years of work and millions of dollars before it draws the first drop of oil from Tiber. Such long waits are not uncommon. Three years after announcing a discovery at a site in the Gulf called Kaskida, BP has yet to begin producing oil there.

Projects like the Tiber well will not reduce U.S. dependency on foreign oil, which continues to grow. But new technology does permit access to major oil finds closer to U.S. shores.

BP expects Tiber to be among the company's richest finds in the Gulf on par with its crown jewel, the Thunder Horse development. Thunder Horse produces about 300,000 barrels of oil equivalent per day, as much crude as half of Alaska's famous North Slope.

Even if Tiber produces that much, it would still be a trickle compared with the largest oil producers in the world -- the Ghawar field in Saudi Arabia, which produces 5 million barrels per day.

But because it's close to home, Tiber would be especially attractive to refiners in America, where the government wants to cut down on oil imports from the Middle East.

"Early indications are that it's a significant positive discovery," said Matt Snyder, lead analyst with Wood MacKinzie's Gulf of Mexico research team.

Exploration companies recently have been pushing drilling operations farther from shore because of technological improvements that allow them to handle extreme depths and pressure, Snyder said.

It's an expensive process. A production platform costs more than $1 billion to build. Drilling a deep-water well can add another $100 million, and if crude is located, it could cost another $50 million to bring the oil to the surface.

"And when they finally get down there, it's very hot," said Leta Smith, a director with Cambridge Energy Research Associates' Global Oil Supply Group.

"It could be upwards of 250 degrees Fahrenheit. The pressures can be the most challenging aspect of it. These rocks are over-pressured, which means you need to have a lot of special equipment."

For an ambitious project like Tiber to pay off, experts say crude must cost at least $70 to $75 per barrel, though lower prices have never slowed the industry. When crude prices fell below $20 per barrel in the late 1990s, exploration and Thunder Horse never slowed.

"They're not swayed by daily price swings when it comes to planning deep-water exploration," Priest said.

BP's discovery is the latest in what's called the "lower tertiary" region, an ancient section of rock in the Gulf that is roughly 300 square miles and formed between 24 million and 65 million years ago.

Chevron Corp. drilled one of the first wells in the region in 2001, followed by more than a dozen others from companies such as Royal Dutch Shell, Australian oil company BHP Billiton, BP and Total SA, according to the U.S. Department of Interior's Minerals Management Service.

In 2006, Chevron estimated that the lower tertiary holds between 3 billion and 15 billion barrels. But it has taken years to develop wells for commercial use.

Smith said that the first drops of crude from the lower tertiary will arrive in 2010 with Shell's Perdido operation and Petrobras's Cascade and Chinook developments.

BP has a 62 percent working interest in the Tiber well. Petrobras owns 20 percent while ConocoPhillips owns 18 percent.

Wednesday, September 02, 2009 | 1 Comments

SEC bungled Madoff probes, agency watchdog says

SEC badly bungled probes of Madoff scheme, agency watchdog says -- incompetence, not corruption

WASHINGTON (AP) -- Pushing past years of "red flags," investigators at the Securities and Exchange Commission bungled their probes of Bernard Madoff so badly that his multibillion-dollar fraud not only flourished but he used the exams to suck in new investors, an agency watchdog declared Wednesday.

The report by the SEC inspector general shows that no smoking gun of corruption was found in the agency's conduct toward the disgraced financier. Instead it painted a grim picture of an agency hobbled by incompetence -- failing to pursue the most obvious leads -- that cleared the way for Madoff to continue what could be the biggest Ponzi scheme in U.S. history for more than a decade.

One of the most striking points in the report is that the investigations actually may have made things worse.

"Madoff proactively informed potential investors that the SEC had examined his operations" and found nothing amiss, it says. The fact that three SEC inspections and two investigations failed to detect the fraud gave credibility to Madoff's operations and encouraged more people to give him their money.

The report by inspector general David Kotz cites no evidence of improper ties between agency officials and Madoff, nor of senior SEC officials trying to influence the agency's probes of his business. Speculation had raged in December, when Madoff confessed to the scheme, that the financier's influence and ties to the SEC as a prominent Wall Street figure had prompted agency officials to pull their punches in investigations of his business.

The SEC enforcement staff "almost immediately caught (him) in lies and misrepresentations but failed to follow up on inconsistencies" and rejected whistleblowers' offers to provide additional evidence, the report says.

"The fact that for 16 years (the SEC) had on blinders and earmuffs is mind-numbing," said Jacob Frenkel, a former SEC enforcement attorney and federal prosecutor now in private law practice.

Four high-ranking SEC officials who were lambasted over the Madoff affair at a congressional hearing in February -- including the enforcement director and the head of the inspections office -- have left the agency.

SEC Chairman Mary Schapiro, appointed by President Barack Obama, took the helm in January. Enforcement efforts have been strengthened, and the agency has started a number of initiatives meant to protect investors in the wake of the financial crisis, officials say.

Madoff, who pleaded guilty in March, has begun serving a 150-year sentence in federal prison in North Carolina for a pyramid scheme that destroyed thousands of people's life savings, wrecked charities and gave the financial system yet another big jolt. The legions of investors who lost money included Hollywood celebrities, ordinary people and famous names in business and sports -- as well as big hedge funds, international banks and charitable foundations worldwide.

Revelations in December of the SEC's failure to uncover Madoff's massive scheme over more than a decade touched off one of the most painful scandals in the agency's 75-year history.

The inspector general plans to issue separate audits that will include recommendations for changes in the agency's enforcement and inspection operations.

His report "makes clear that the agency missed numerous opportunities to discover the fraud," new chairman Schapiro said in a statement. "It is a failure that we continue to regret, and one that has led us to reform in many ways how we regulate markets and protect investors."

Sen. Christopher Dodd, chairman of the Senate Banking Committee, said the panel has scheduled a hearing for Sept. 10 on Kotz's report, at which the inspector general is expected to testify. The testimony will "guide us as we continue our work on a bill to modernize financial regulations," Dodd said.

Between June 1992 and last December, the SEC received six "substantive complaints that raised significant red flags" regarding Madoff's operations. But "a thorough and competent investigation or examination was never performed," the Kotz's report says.

For example, Harry Markopolos, a fraud investigator who had worked in the securities industry, brought his allegations to the SEC about improprieties in Madoff's business starting in 2000 after determining there was no way Madoff could have been making the consistent returns he claimed. Markopolos and his investigators raised 29 specific warnings regarding Madoff's operations to SEC staff members in Boston, New York and Washington.

The agency also received complaints from a number of other sources, all containing specific information that called for a thorough examination of Madoff's business, the report says.

Many of the SEC staff members who conducted the investigations were "inexperienced," according to the report.

It cites examinations of Madoff's business done in 2004 and 2005 by the agency's inspections office. In both exams, the staff "made the surprising discovery" that Madoff's mysterious investment business was making far more money than his well-known wholesale brokerage operation. "However, no one identified this revelation as a cause for concern," the report says.

Madoff himself, who was once chairman of the Nasdaq Stock Market and had sat on SEC advisory committees, had boasted of his ties to the agency.

The inspector general's investigation found no evidence, though, that any SEC staff who worked on the exams or investigations of Madoff's business had financial or other improper connections with him that influenced the probes.

The disclosure in December of the agency's failure in the Madoff affair, coming after the financial crisis struck last fall, buttressed the mounting criticism from lawmakers and investor advocates that Wall Street and regulators in Washington had grown too close.

Christopher Cox, then the SEC chairman, responded by delivering a stunning rebuke to his own career staff, blaming them for the failure to uncover Madoff's wrongdoing. Cox's critics said targeting the staff was his attempt to salvage his own reputation.

Wednesday, September 02, 2009 | 0 Comments

Group: Insurers urged workers to fight reform

Consumer group says 2 health insurers illegally told workers to lobby against health reform

NEW YORK (AP) -- A consumer group says health insurers UnitedHealth and WellPoint pressured their employees to contact members of Congress and lobby against health care reform proposals that the companies disagreed with.

In a letter to California Attorney General Jerry Brown, the group Consumer Watchdog maintains both companies violated state labor laws. The group said Brown should investigate the insurers based on comments they sent to employees last month, while Congress was in recess and debate about health care reform was highly publicized.

The Attorney General's office said it is reviewing the letter.

In one e-mail, Minnetonka, Minn.-based UnitedHealth Group Inc. said workers looking to get in touch with elected officials could get help from "advocacy specialists." It said employees might be contacted about the issue during business hours.

WellPoint Inc., a Blue Cross/Blue Shield operator based in Indianapolis, said most of the proposed health care legislation was not responsible or sustainable. Its e-mail asserted that the laws could cause tens of millions of Americans to lose private health coverage and end up in a government-run insurance plan. Other consequences could include limited choice for customers, and increased premiums for those with private coverage due to new mandates and coverage requirements, it said.

Both companies run their own advocacy groups -- UnitedHealth's United for Health Reform, and WellPoint's Health Action Network. United's e-mail said United for Health Reform may contact employees, and specialists would be available to help the workers craft letters to their representatives.

"By working with an advocacy specialist to personalize your message, you can quickly and easily add your voice to this historic debate," the e-mail says. The letter advises employees to attend a town hall meeting, and encourages respectful and constructive comments.

WellPoint said Wednesday it has not been contacted by the Attorney General's office and has not seen any complaint.

"We believe it is important and permissible to provide up to date information about health reform to our associates," spokeswoman Cheryl Leamon said in an e-mail to The Associated Press.

UnitedHealth, responding to a request for comment, referred to its statement last month saying it had not encouraged employees to attend "anti-reform rallies." The company said it had only provided workers with information so they could contact elected officials or attend town halls if they chose to do so.

"We have stressed repeatedly that we strongly support bipartisan reform efforts to modernize health care and improve access to quality care on a sustainable basis for all Americans," the company wrote on Aug. 20.

Wednesday, September 02, 2009 | 0 Comments

Pfizer to pay record $2.3B penalty for drug promos

Repeat offender Pfizer paying record $2.3B settlement for illegal drug promotions

WASHINGTON (AP) -- Federal prosecutors hit Pfizer Inc. with a record-breaking $2.3 billion in fines Wednesday and called the world's largest drugmaker a repeating corporate cheat for illegal drug promotions that plied doctors with free golf, massages, and resort junkets.

Related Quotes

| Symbol | Price | Change |

|---|---|---|

| PFE | 16.28 | -0.10 |

| | ||

| WYE | 47.56 | -0.23 |

| | ||

Announcing the penalty as a warning to all drug manufacturers, Justice Department officials said the overall settlement is the largest ever paid by a drug company for alleged violations of federal drug rules, and the $1.2 billion criminal fine is the largest ever in any U.S. criminal case. The total includes $1 billion in civil penalties and a $100 million criminal forfeiture.

Authorities called Pfizer a repeat offender, noting it is the company's fourth such settlement of government charges in the last decade. The allegations surround the marketing of 13 different drugs, including big sellers such as Viagra, Zoloft, and Lipitor.

As part of its illegal marketing, Pfizer invited doctors to consultant meetings at resort locations, paying their expenses and providing perks, prosecutors said.

"They were entertained with golf, massages, and other activities," said Mike Loucks, the U.S. attorney in Massachusetts.

Loucks said that even as Pfizer was negotiating deals on past misconduct, they were continuing to violate the very same laws with other drugs.

To prevent backsliding this time, Pfizer's conduct will be specially monitored by the Health and Human Service Department inspector general for five years.

In an unusual twist, the head of the Justice Department, Attorney General Eric Holder, did not participate in the record settlement, because he had represented Pfizer on these issues while in private practice.

Associate Attorney General Thomas Perrelli said the settlement illustrates ways the Justice Department "can help the American public at a time when budgets are tight and health care costs are rising."

Perrelli announced the settlement terms at a news conference with federal prosecutors and FBI, and Health and Human Services Department officials.

The settlement ends an investigation that also resulted in guilty pleas from two former Pfizer sales managers.

Officials said the U.S. industry has paid out more than $11 billion in such settlements over the past decade, but one consumer advocate voiced hope that Wednesday's penalty was so big it would curb the abuses.

"There's so much money in selling pills, that there's a tremendous temptation to cheat," said Bill Vaughan, an analyst at Consumers Union, the nonprofit publisher of Consumer Reports.

"There's a kind of mentality in this sector that (settlements) are the cost of doing business and we can cheat. This penalty is so huge I think consumers can have some hope that maybe these guys will tighten up and run a better ship."

The government said the company promoted four prescription drugs, including the pain killer Bextra, as treatments for medical conditions different from those the drugs had been approved for by federal regulators. Authorities said Pfizer's salesmen and women created phony doctor requests for medical information in order to send unsolicited information to doctors about unapproved uses and dosages.

Use of drugs for so-called "off-label" medical conditions is not uncommon, but drug manufacturers are prohibited from marketing drugs for uses that have not been approved by the Food and Drug Administration. They said the junkets and other company-paid perks were designed to promote Bextra and other drugs, to doctors for unapproved uses and dosages, backed by false and misleading claims about safety and effectiveness.

Bextra, for instance, was approved for arthritis, but Pfizer promoted it for acute pain and surgical pain, and in dosages above the approved maximum. In 2005, Bextra, one of a class of painkillers known as Cox-2 inhibitors, was pulled from the U.S. market amid mounting evidence it raised the risk of heart attack, stroke and death.

A Pfizer subsidiary, Pharmacia and Upjohn Inc., which was acquired in 2003, has entered an agreement to plead guilty to one count of felony misbranding. The criminal case applied only to Bextra.

The $1 billion in civil penalties was related to Bextra and a number of other medicines.

A portion of the civil penalty will be distributed to 49 states and the District of Columbia, according to agreements with each state's Medicaid program.

Pfizer's top lawyer, Amy Schulman, said the settlements "bring final closure to significant legal matters and help to enhance our focus on what we do best -- discovering, developing and delivering innovative medicines."

In her statement, Schulman said: "We regret certain actions taken in the past, but are proud of the action we've taken to strengthen our internal controls and pioneer new procedures."

In financial filings in January, the company had indicated that it would pay $2.3 billion over the allegations.

The civil settlement announced Wednesday covered Pfizer's promotions of Bextra, blockbuster nerve pain and epilepsy treatment Lyrica, schizophrenia medicine Geodon, antibiotic Zyvox and nine other medicines. The agreement with the Justice Department resolves the investigation into promotion of all those drugs, Pfizer said.

The government said Pfizer also paid kickbacks to market a host of big-name drugs: Aricept, Celebrex, Lipitor, Norvasc, Relpax, Viagra, Zithromax, Zoloft, and Zyrtec.

The allegations came to light thanks largely to five Pfizer employees and one Pennsylvania doctor, who will now share $102 million of the settlement money.

FBI Assistant Director Kevin Perkins praised the whistleblowers who decided to "speak out against a corporate giant that was blatantly violating the law and misleading the public through false marketing claims."

To rein in the abuses, the government's five-year monitoring will force Pfizer to notify doctors about Wednesday's agreement, encourage them to report any similar behavior, and publicly post any payments or perks it gives to doctors.

Under terms of the settlement, Pfizer must pay $1 billion to compensate Medicaid, Medicare, and other federal health care programs. Some of that money will be shared among the states: New York, for example, will receive $66 million, according to the state's attorney general, Andrew Cuomo.

When Pfizer originally disclosed the settlement figure, it also announced plans to acquire rival Wyeth for $68 billion. That deal, which would bolster Pfizer's position as the world's top drugmaker by revenue, is expected to close before year's end.

Shares of Pfizer dropped 14 cents to $16.24 in midday trading.

Wednesday, September 02, 2009 | 0 Comments

Fed minutes: officials saw recession's end in Aug.

WASHINGTON (AP) -- With the U.S. economy on the mend, Federal Reserve policymakers last month felt comfortable slowing the pace of one of its economic revival programs and not changing any others, according to documents released Wednesday.

Related Quotes

| Symbol | Price | Change |

|---|---|---|

| FNM | 1.37 | -0.22 |

| | ||

| FRE | 1.64 | -0.26 |

| | ||

Minutes of the central bank's closed door deliberations, held Aug. 11-12, also showed Fed Chairman Ben Bernanke and his colleagues striking a much more hopeful note about the economy's prospects compared with an assessment made in late June. Many Fed officials saw "smaller downside risks," the documents stated.

Fed officials expected the pace of the recovery to "pick up" in 2010, but there was a range of views -- and considerable uncertainty -- about the likely strength of the upturn because of concerns about how consumers will behave.

After being pounded by the recession, consumer spending finally appeared to be leveling out, the housing market was firming and manufacturing was stabilizing, the Fed said. Plus, the outlook for other countries' economies improved, auguring well for the sale of U.S. exports.

All that strengthened the confidence of Fed officials that "the downturn in economic activity was ending." They also repeated a prediction that the economy would start growing again in the second half of this year. That expected growth will be helped by President Barack Obama's $787 billion package of tax cuts and increased government spending, they said.

Against that backdrop, the Fed at its August meeting, announced that it would gradually slow the pace of its program to buy the remainder of $300 billion worth of Treasury securities and shut it down at the end of October, a month later than previously scheduled. The program is designed to force interest rates down for mortgages and other consumer debt, and spur Americans to spend more money.

The Fed also did not change another program that aims to push down mortgage rates. In that venture, the Fed is on track to buy $1.25 trillion worth of securities issued by mortgage finance companies Fannie Mae and Freddie Mac by the end of the year.

"With the downside risks to the economic outlook now considerably reduced, but the economic recovery likely to be damped" Fed policymakers agreed that it didn't need to either expand or cut back those programs.

Summing up the Fed minutes, "the overriding theme is that the economy was just beginning to turn around," said Stephen Stanley, chief economist at RBS.

Fed officials suggested consumers will be a wild card in the unfolding recovery.

A "poor" jobs market, evaporated wealth from decimated home and stock values, hard-to-get credit and wages that aren't supposed to advance sharply anytime soon mean consumers are still facing "considerable headwinds," the minutes said. How consumers behave is crucial to the recovery because their spending accounts for roughly 70 percent of all economic activity.

"With these forces restraining spending, and with labor income likely to remain soft, (Fed) participants generally expected no more than moderate growth in consumer spending going forward," the Fed minutes stated.

Unemployment -- now at 9.4 percent and expected to top 10 percent this year-- is the biggest burden facing American consumers. Another source of uncertainty: the extent to which consumers will sock more money into savings, the Fed said.

To entice consumers to spend more, the Fed last month also left a key interest rate at a record low of near zero. It pledged to hold that bank lending rate at between zero and 0.25 percent for an "extended period." Economists predict that means through the rest of this year and may be longer.

"We suspect that it won't raise interest rates possibly until 2011," said Paul Dales, economist at Capital Economics Ltd.

As a result, commercial banks' prime lending rate, used as a peg for rates on home equity loans, certain credit cards and other consumer loans, will stay at about 3.25 percent, the lowest in decades.

Given weakness in the job market and that factories -- while improving -- are far from full throttle, inflation should stay contained, the Fed said. Fed officials did, however, acknowledge that some on Wall Street have expressed worry that the central bank's aggressive actions and the federal government's bloated budget deficit will spur inflation later on.

To address those concerns, the Fed said it is important to keep sending the message that it has the will and the tools necessary to reel in the trillions of dollars it has pumped into the financial system to revive the economy.

Wednesday, September 02, 2009 | 0 Comments

Charts 2 Sep

Dow9,280.67-29.93-0.32%

Nasdaq1,967.07-1.82-0.09%

S&P 500994.75-3.29-0.33%

10 Yr Bond(%)3.2950%-0.0800

Oil68.23+0.18+0.26%

Gold978.10+1.50+0.15%

Wednesday, September 02, 2009 | 0 Comments

| EUR/USD | 1.4306 | -0.0037 |

| USD/JPY | 93.1550 | + 0.1700 |

| GBP/USD | 1.6212 | -0.0076 |

Tuesday, September 01, 2009 | 0 Comments

Sep, 1 2009

Dow9,487.44-8.84-0.09%

Nasdaq2,016.87+7.81+0.39%

S&P 5001,019.46-1.16-0.11%

10 Yr Bond(%)3.4580%+0.0570

Oil70.87+0.91+1.30%

Gold954.20+2.50+0.26%

Tuesday, September 01, 2009 | 0 Comments

Stock Screening Basics

How to Use Online Stock Screens to Identify Investment Candidates

Back when Fred Flintstone and I were researching stocks (that is, before the Internet), we had to either rely on the advice of a broker who was paid only when we bought or sold or we had to dig through mounds of annual reports, 10-Qs, and an assortment of documents that were months old by the time we got them.

Researching more than a few companies was almost impossible unless you had a staff of analysts working for you. Comparing several companies was tedious and difficult.

Thank goodness, the “good old days” are gone forever.

Today, any investor can access powerful research tools that before the Internet were not available and many of them are free. Of course, there are some very sophisticated tools that come with hefty price tags; however, for most investors all the research they’ll need is free or available for a modest subscription.

Stock Screener

The most basic research tool is the stock screener. This handy program does in nanoseconds what would take you hours and hours of research by hand to do – and best of all, there are many of them on the Internet free for you to use. Some of the better ones come as part of subscription packages to the better research sites, but you can get a feel for how they work for free.The concept is simple. You want to identify stocks that meet certain criteria. (Incidentally, this is how you go about building a portfolio, rather than haphazardly investing in whatever stock looks good at the moment.)

Stock screening programs allow you to enter qualifiers such as industry type, market cap, sales, dividends, and so forth. The more sophisticated the screen, the larger number of qualifiers.

After you put in all the qualifiers, the screener looks at all the companies listed on the major exchanges and pulls out those that meet your qualifications. You get a list of the companies. If the list is too large, you can run the screen again with tighter qualifications to reduce the number of hits.

The more sophisticated screeners allow you to run further screens on the set you just generated, while the free screeners tend to leave you with just the list. Either way, you have just saved yourself hours and hours of work by narrowing down the possible candidates.

MSN Money.com

One of the simplest and easiest to use comes from MSN Money.com. Despite its simplicity, the screen yields some powerful results.The screen lists your results with links to each company. Click on the link and you will get a financial snapshot of the company. It is a powerful tool to get you started.

Once you are comfortable with the basic screener, download the free deluxe screener. It takes some getting used to and is much more detailed than the simple screen, however if you really want to narrow in (and, ultimately, you do) on investment targets, get to know your way around screeners like this one.

Many look and work very much alike, but you need to know what you are looking for and what you need to ask from the screener before they can be of real benefit. The great thing about using the free screeners like this one from MSN.com is you can spend all the time you need experimenting and testing without running up a big bill.

Stock screeners are just one tool; however, they should be the first tool you master as you begin learning to do research.Friday, August 07, 2009 | 0 Comments

Trading Basics

Basic Steps in How Stock Trading Works

Trading stocks. You hear that phrase all the time, although it really is wrong – you don’t trade stocks like baseball cards (I’ll trade you 100 IBMs for 100 Intels).

Trade = Buy or Sell

To “trade” means to buy and sell in the jargon of the financial markets. How a system that can accommodate one billion shares trading in a single day works is a mystery to most people. No doubt, our financial markets are marvels of technological efficiency.Yet, they still must handle your order for 100 shares of Acme Kumquats with the same care and documentation as my order of 100,000 shares of MegaCorp.

You don’t need to know all of the technical details of how you buy and sell stocks, however it is important to have a basic understanding of how the markets work. If you want to dig deeper, there are links to articles explaining the technical side of the markets.

Two Basic Methods

There are two basic ways exchanges execute a trade:

- On the exchange floor

- Electronically

There is a strong push to move more trading to the networks and off the trading floors, however this push is meeting with some resistance. Most markets, most notably the NASDAQ, trade stocks electronically. The futures’ markets trade in person on the floor of several exchanges, but that’s a different topic.

Exchange floor

Trading on the floor of the New York Stock Exchange (the NYSE) is the image most people have thanks to television and the movies of how the market works. When the market is open, you see hundreds of people rushing about shouting and gesturing to one another, talking on phones, watching monitors, and entering data into terminals. It could not look any more chaotic.

Yet, at the end of the day, the markets workout all the trades and get ready for the next day. Here is a step-by-step walk through the execution of a simple trade on the NYSE.

- You tell your broker to buy 100 shares of Acme Kumquats at market.

- Your broker’s order department sends the order to their floor clerk on the exchange.

- The floor clerk alerts one of the firm’s floor traders who finds another floor trader willing to sell 100 shares of Acme Kumquats. This is easier than is sounds, because the floor trader knows which floor traders make markets in particular stocks.

- The two agree on a price and complete the deal. The notification process goes back up the line and your broker calls you back with the final price. The process may take a few minutes or longer depending on the stock and the market. A few days later, you will receive the confirmation notice in the mail.

Of course, this example was a simple trade, complex trades and large blocks of stocks involve considerable more detail.

Electronically

In this fast moving world, some are wondering how long a human-based system like the NYSE can continue to provide the level of service necessary. The NYSE handles a small percentage of its volume electronically, while the rival NASDAQ is completely electronic.The electronic markets use vast computer networks to match buyers and sellers, rather than human brokers. While this system lacks the romantic and exciting images of the NYSE floor, it is efficient and fast. Many large institutional traders, such as pension funds, mutual funds, and so forth, prefer this method of trading.

For the individual investor, you frequently can get almost instant confirmations on your trades, if that is important to you. It also facilitates further control of online investing by putting you one step closer to the market.

You still need a broker to handle your trades – individuals don’t have access to the electronic markets. Your broker accesses the exchange network and the system finds a buyer or seller depending on your order.

Conclusion

What does this all mean to you? If the system works, and it does most of the time, all of this will be hidden from you, however if something goes wrong it’s important to have an idea of what’s going on behind the scenes.Friday, August 07, 2009 | 0 Comments

Understanding Risk

Risk and Reward are Part of Investing

“No pain, no gain.” How many times have you heard that cliché to describe something you really didn’t want to do? Unfortunately, investing carries a certain amount of risk and with that risk can come some pain, but also some gain.

You must weigh the potential reward against the risk of an investment to decide if the “pain is worth the potential gain.” Understanding the relationship between risk and reward is a key piece in building your personal investment philosophy.

Carry Risk

All investments carry some degree of risk. The rule of thumb is “the higher the risk, the higher the potential return,” but you need to consider an addition to the rule so that it states the relationship more clearly: “the higher the risk, the higher the potential return, and the less likely it will achieve the higher return.”To understand this relationship completely, you must know where your comfort level is and be able to correctly gauge the relative risk of a particular stock or other investment.

Will I Lose Money?

Most people think of investment risk in one way: “How likely am I to lose money?” This statement describes only part of the picture, however. You should consider that risk and others when evaluating an investment:- Are my investments going to lose money? (Is safety of principal more important than growth?)

- Will I achieve my investment goal? (Under-funding retirement, for example.)

- Am I will to accept more risk to achieve higher returns? (Are my investments going to keep me awake at night with worry?)

Let’s look at these concerns about risk.

Am I Going to Lose Money?

The most common type of risk is the danger your investment will lose money. You can make investments that guarantee you won’t lose money, but you will give up most of the opportunity to earn a return in exchange.

For example, U.S. Treasury bonds and bills carry the full faith and credit of the United States behind them, which makes these issues the safest in the world. Bank certificates of deposit (CDs) with a federally insured bank are also very secure.

However, the price for this safety is a very low return on your investment. When you calculate the effects of inflation on your investment and the taxes you pay on the earnings, your investment may return very little in real growth.

Will I Achieve My Financial Goals?

The elements that determine whether you achieve your investment goals are:

- Amount invested

- Length of time invested

- Rate of return or growth

- Less fees, taxes, inflation, etc.

If you can’t accept much risk in your investments, then you will earn a lower return as noted in the previous section. To compensate for the lower anticipated return, you must increase the amount invested and the length of time invested.

Many investors find that a modest amount of risk in their portfolio is an acceptable way to increase the potential of achieving their financial goals. By diversifying their portfolio with investments of various degrees of risk, they hope to take advantage of a rising market and protect themselves from dramatic losses in a down market.

Am I Willing to Accept Higher Risk?

Every investor needs to find his or her comfort level with risk and construct an investment strategy around that level. A portfolio that carries a significant degree of risk may have the potential for outstanding returns, but it also may fail dramatically.

Your comfort level with risk should pass the “good night’s sleep” test, which means you should not worry about the amount of risk in your portfolio so much as to lose sleep over it.